Accountable Form Management

Accountable Form Management

Overview

Accountable Forms (AF) is a general term for receipt forms or official receipts. Being representation of money received, issuance has to be controlled and each form must be monitored in the system. Accountable forms are classified as serial and non-serial. Serial refers to the numbered receipts like Form 51, 56, 58. The non-serial receipts include cash tickets, or receipts containing money value.

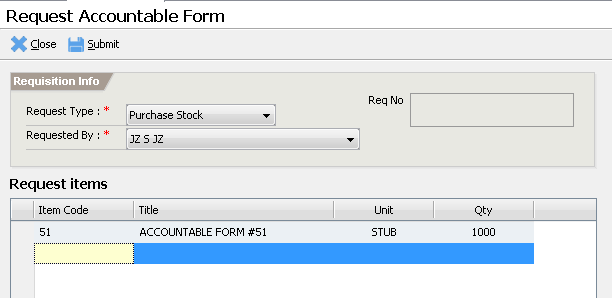

Collectors cannot collect unless they have accountable forms on hand. If they do not yet have accountable forms, they must first create a request through an RIS( Requisition Issue Slip) for Accountable forms and specify which accountable form they want to request.

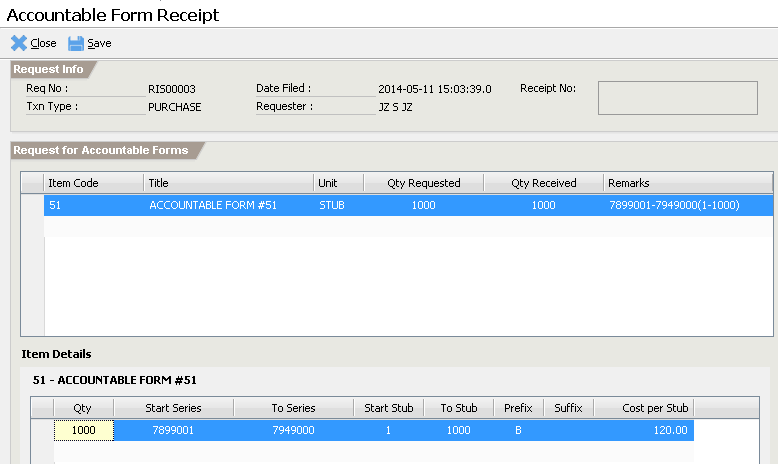

The Accountable Form Officer (AFO) is the one in charge of the inventory of accountable forms and in ensuring that there is enough stock on hand. The AFO receives requests from the collectors. If there is not enough stock, the AFO will also create a request intended for national printing office or another LGU where they will order stock. Once the stock arrives, they will create a receiving document to add the new stock to the inventory.

Replenishing Accountable Forms

Receiving Accountable Forms

Request Accountable Forms for Collector

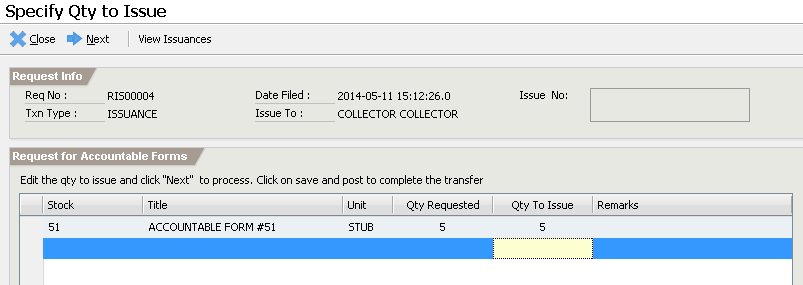

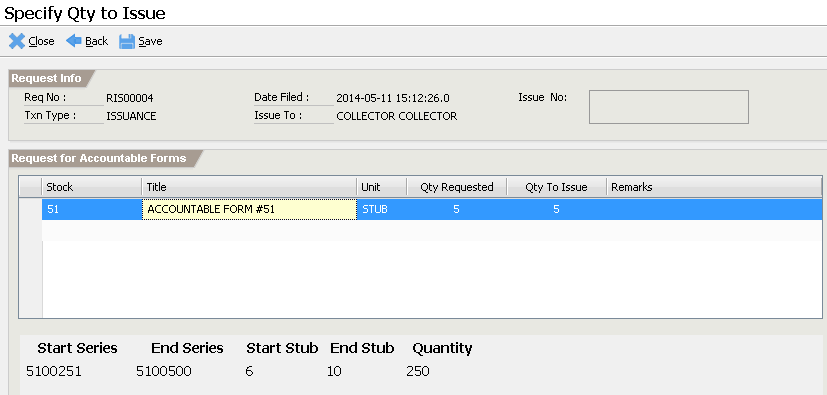

Issue Accountable Forms for Collection

Request Accountable Forms for Sale

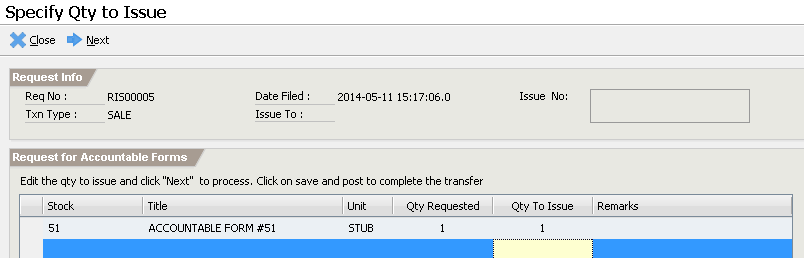

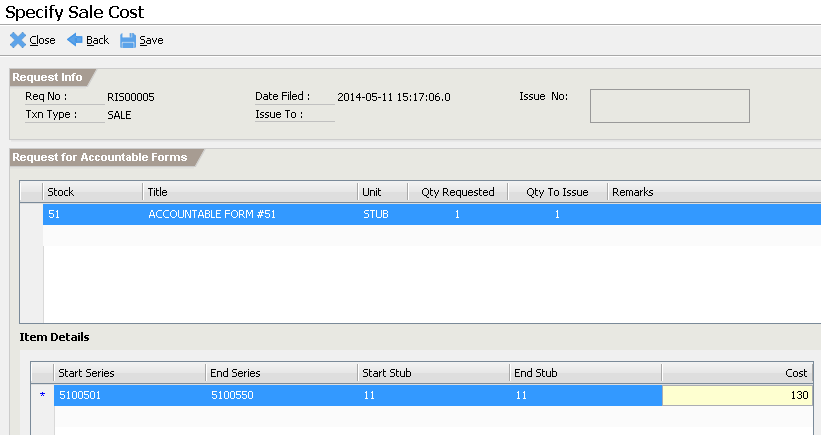

Issue Accountable Forms for Sale

Handling Returns of Accountable Forms

Viewing Accountable Form Inventory

Transactions

Manage Accountable Forms

Requesting Accountable Forms

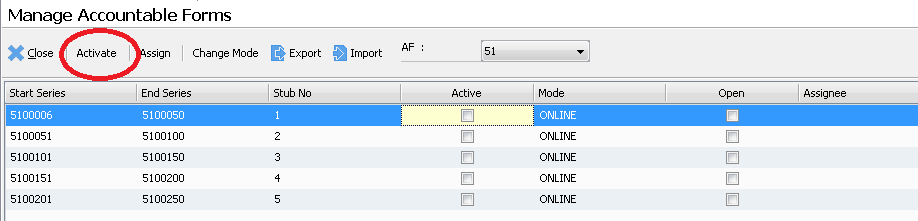

Activating Accountable Forms

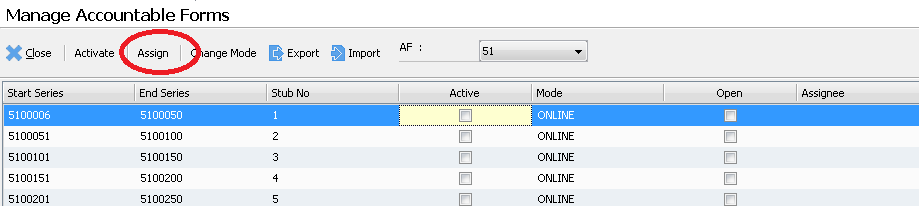

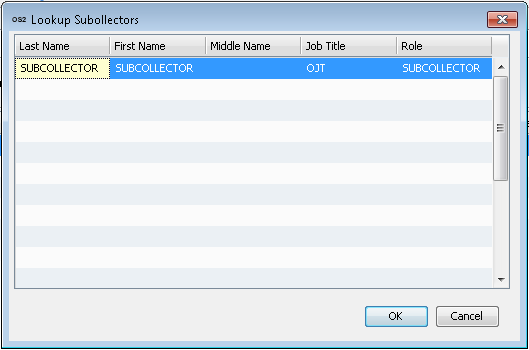

Assigning Accountable Forms to Subcollector

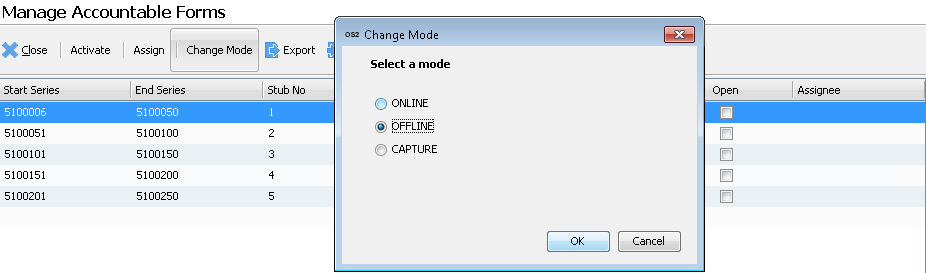

Changing Accountable Form Mode

Cancellation of Accountable Form Series

Online Collection

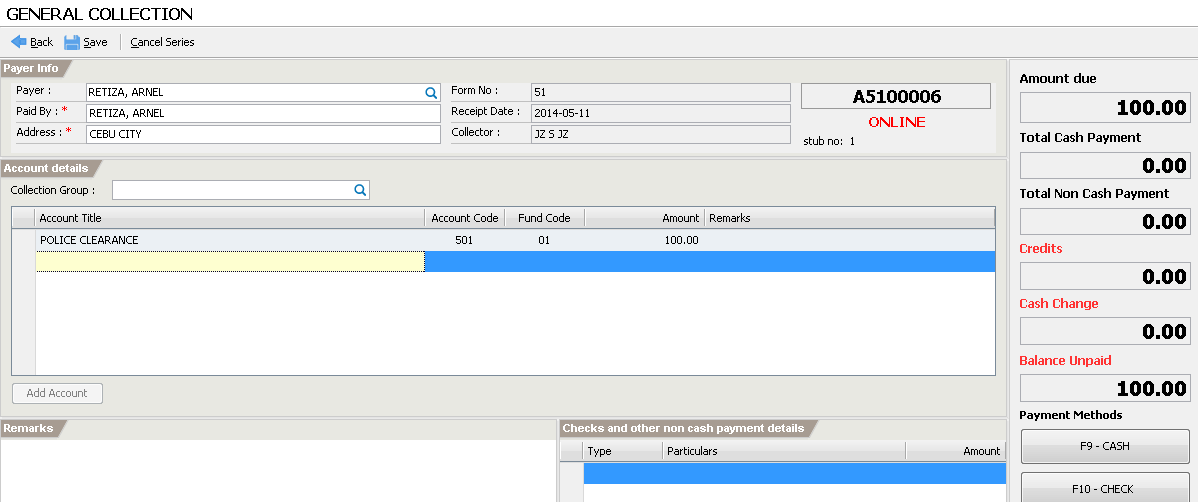

Performing Online Collections

Specifying Payments

CASH

CHECK

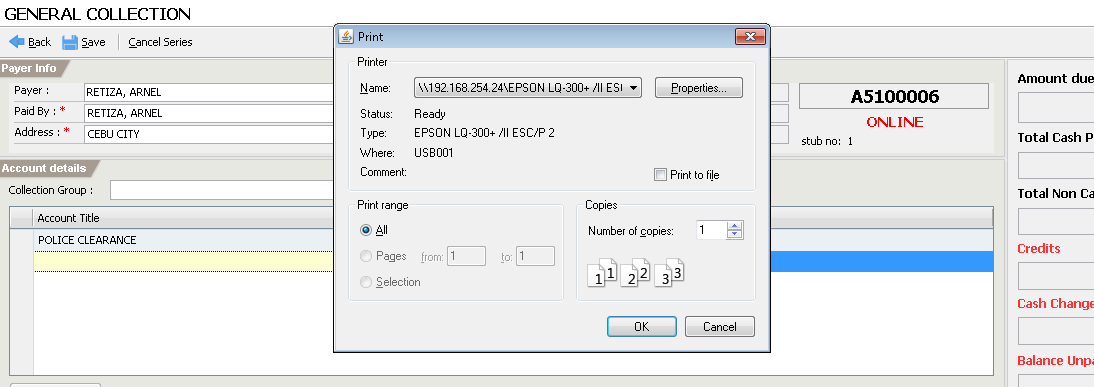

Printing of Receipt

Collection Detail Totals

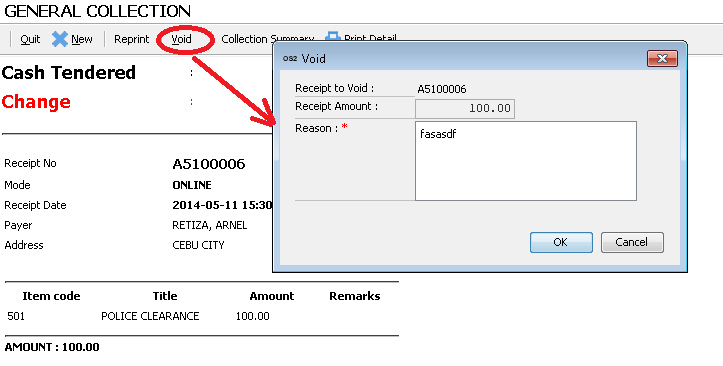

Voiding Receipts

Offline Collection

Performing Offline Collections

Field Collection

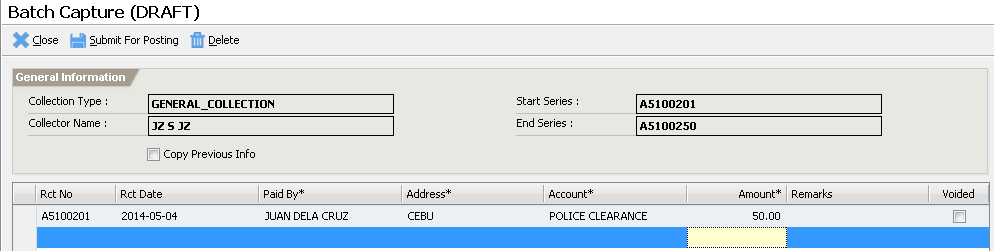

Batch Collection

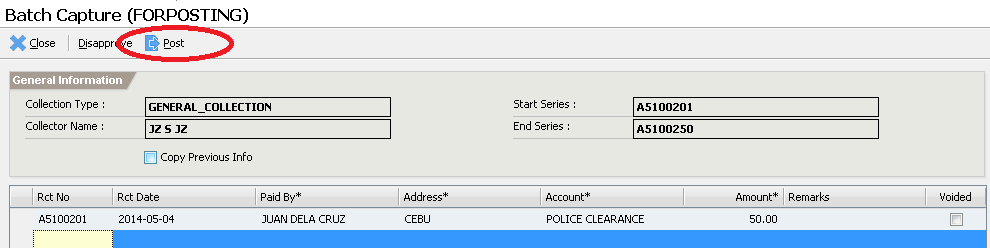

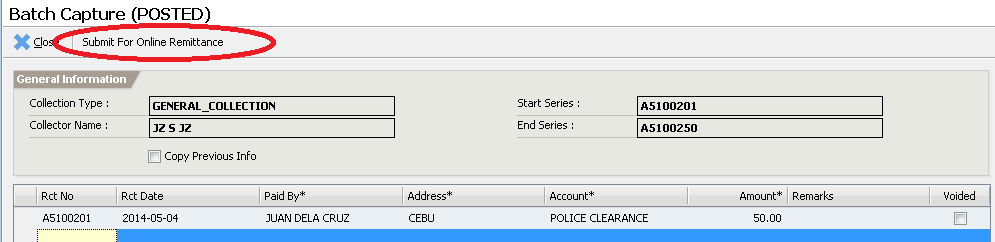

Posting of Batch Collection

Batch Collection Data Controller

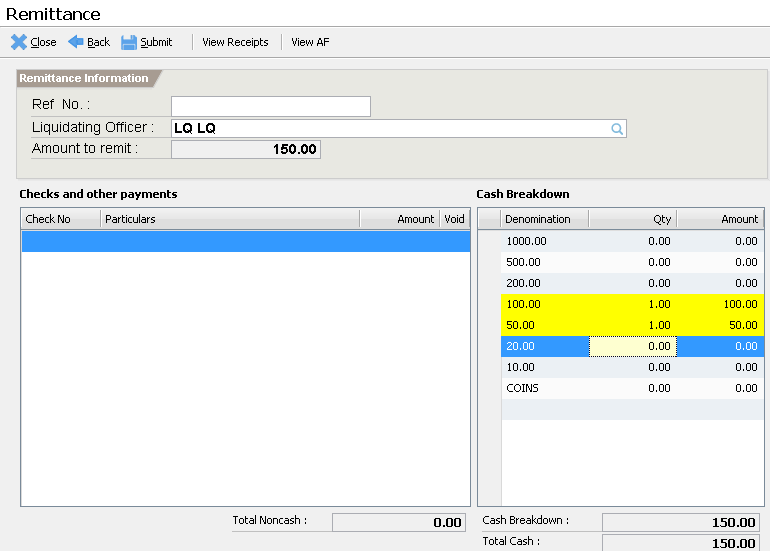

Remittance

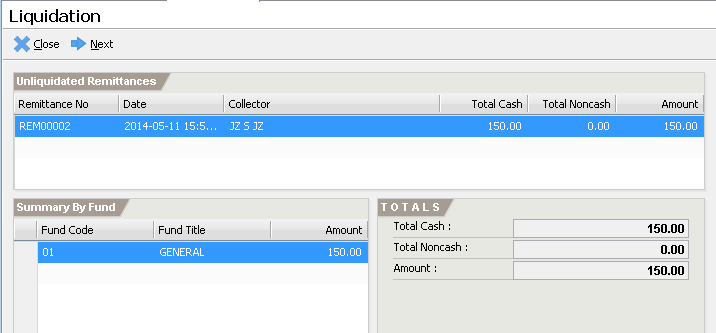

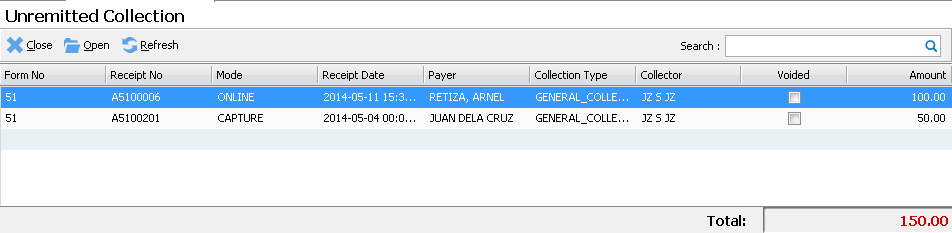

Checking Unremitted Collections

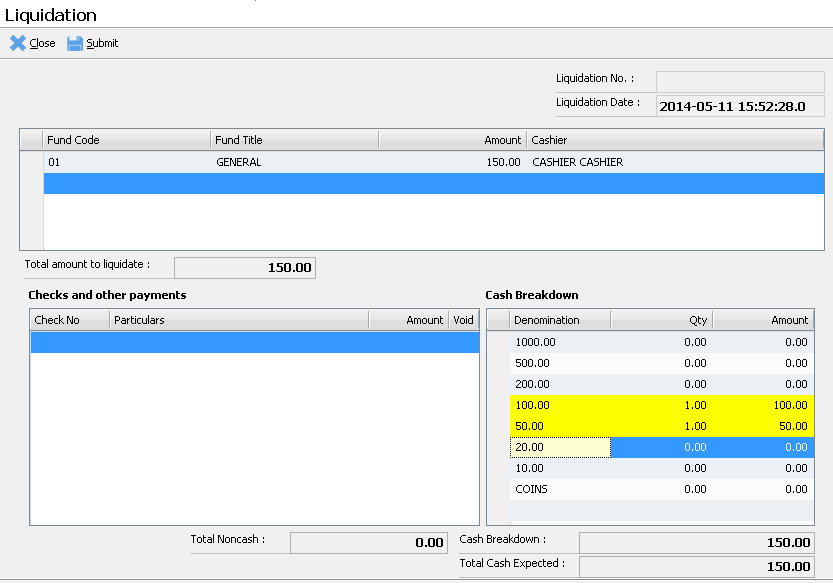

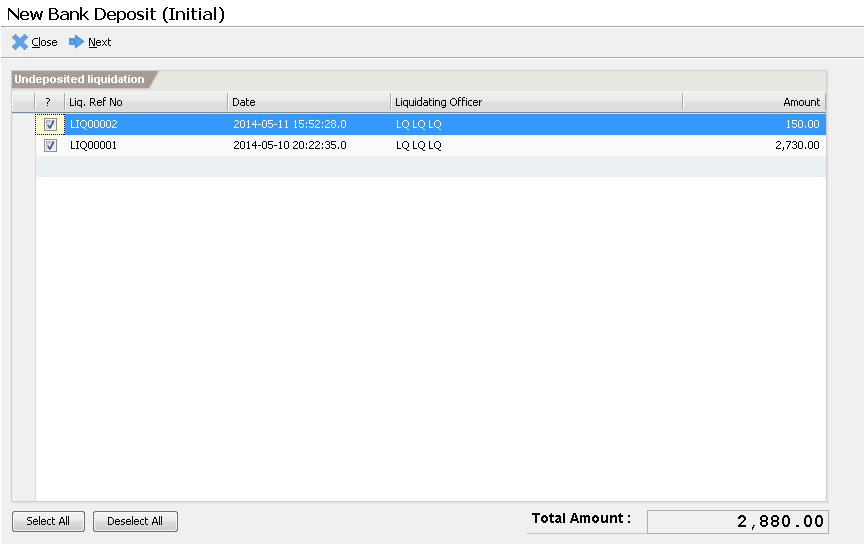

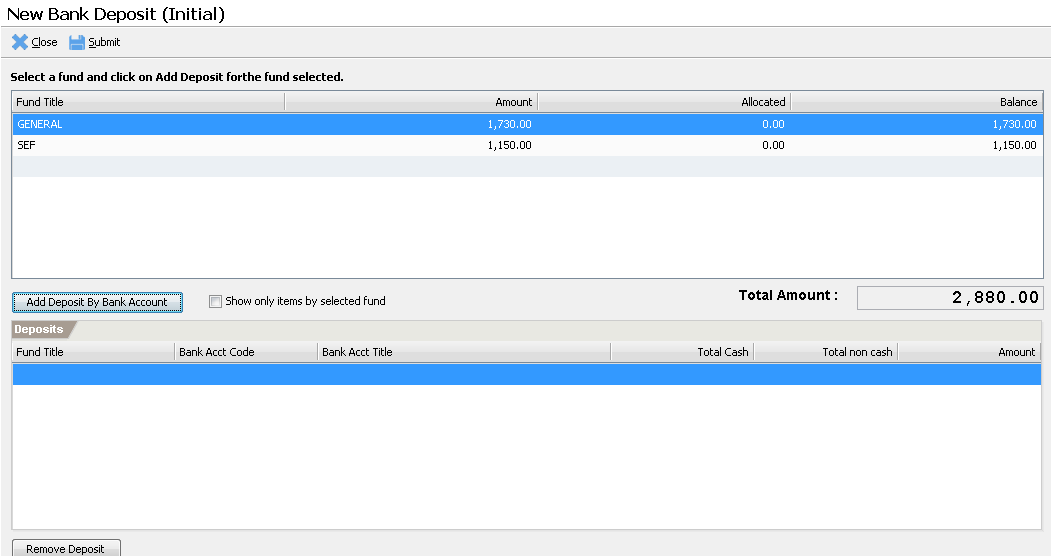

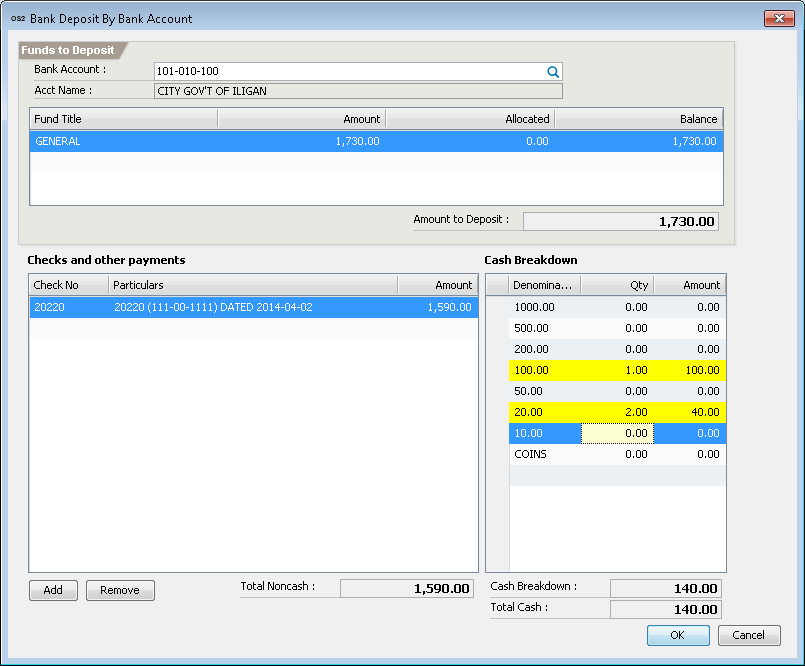

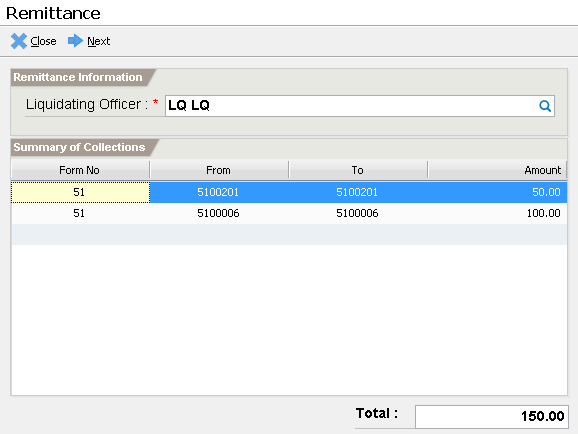

Performing Remittance

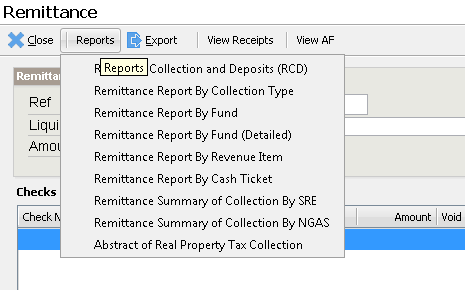

Printing Reports